‘Gentleman’ Jim Fisk, Jay Gould, the Greedy Gold Takeover, and How President Grant Stopped It.

By Ken Zurski

Jim Fisk was a larger than life figure in New York both physically and socially. A farm boy from New England, Fisk worked as a laborer in a circus troupe before becoming a two-bit peddler selling worthless trinkets and tools door to door to struggling farmers. The townsfolk were duped into calling him “Santa Claus” not only for his physical traits but his apparent generosity as well. When the Civil War came, Fisk made a fortune smuggling cotton from southern plantations to northern mills.

So by the time he reached New York, Fisk was a wealthy man. He also spent money as fast as he could make it; openly cavorted with pretty young girls; and lavished those he admired with expensive gifts and nights on the town. Fisk never hid behind his actions even if they were corrupt. He would chortle at his own genius and openly embarrass those he was cheating. He earned the dubious nickname “Gentleman” for being polite and loyal to his friends.

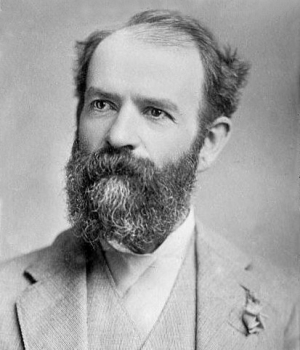

Friends like Jay Gould

A leather maker turned New York railroad owner, Gould was the youngest of six children, the only boy, and a scrawny one at that; growing up to be barely five feet tall. What he lacked in size, however, he made up for in ambition.

A financial whiz even as a young man, Gould started surveying and plotting maps for land in rural New York, where he grew up. It was tough work, but not much pay, at least not enough for Gould. In 1856 he met a successful tanner – good work at the time – who taught Gould how to make leather from animal skins and tree bark. Gould found making money just as easy as fashioning belts and bridles. He found a few rich backers, hired a few men and started his own tanning company by literally building a town from scratch in the middle of a vacant but abundant woodland. When the money started to flow, the backers balked, accusing Gould of deception. Their suspicions led to a takeover. The workers, who all lived quite comfortably in the new town they built and named Gouldsborough, rallied around Gould and took the plant back by force, in a shootout no less, although no one was seriously hurt.

Gould won the day, but the business was ruined. By sheer luck, another promising venture opened up. A friend and fellow leather partner had some stock in a small upstate New York railroad line. The line was dying and the stock price plummeted. So Gould bought up the stock, all of it in fact, with what little earnings he had left, and began improving the line. Eventually the rusty trail hooked up with a larger line and Gould was back in business. He now owned the quite lucrative Erie Railroad.

Ten years later, in 1869, Gould got greedy and turned his attentions to gold.

Gold was being used exclusively by European markets to pay American farmers for exports since the U.S currency, greenbacks, were not legal tender overseas. Since it would take weeks, sometime months for a transaction to occur, the price would fluctuate with the unstable gold/greenback exchange rate. If gold went down or the greenback price went up, merchants would be liable -often at a substantial loss – to cover the cost of the fluctuations. To protect merchants against risk, the New York Stock Exchange was created so gold could be borrowed at current rates and merchants could pay suppliers immediately and make the gold payment when it came due. Since it was gold for gold – exchange rates were irrelevant.

Gould watched the markets closely always looking for a way to trade up. He reasoned that if traders, like himself, bought gold then lent it using cash as collateral, large collections could be acquired without using much cash at all. And if gold bought more greenback, then products shipped overseas would look cheaper and buyers would spend more. He had a plan but needed a partner.

He found that person in “Gentleman Jim Fisk.”

Fisk and Gould were already in the business of slippery finance. Besides manipulating railroad stock (Fisk was on the board of the Erie Railroad), they dabbled in livestock and bought up cattle futures when prices dropped to a penny a head. Convinced they could outsmart, out con and outlast anyone, it was time to go after a bigger prize: gold. There was only $20 million in gold available in New York City and nationally $100 million in reserves. The market was ripe for the taking and both men beamed at the prospects.

But the government stood in the way. President Grant was trying to figure out a way to unravel the gold mess, increase shipments overseas and pay off war debts. If gold prices suddenly skyrocketed, as Gould and Fisk had intended, Grant might consider a proposed plan for the government to sell its gold reserves and stabilize the markets; a plan that would leave the two clever traders in a quandary.

Through acquaintances, including Grant’s own brother-in-law, Gould and Fisk met with the president. In June of 1869, they pitched their idea posing as two concerned (a lie) but wealthy (true) citizens who could save the gold markets and raise exports, thus doing the country a favor. They insisted the president let the markets stand and keep the government at bay. Fisk even treated the president to an evening at the opera – in Gould’s private box. The wily general may have been impressed by the opera, but he was also a practical man. He told the two estimable gentlemen that he had no plans to intervene, at least not initially. But Grant really had no idea what the two shysters were up to.

A few months later, when Fisk sent a letter to Grant to confirm the president’s steadfast support, a message erroneously arrived back that Grant had received the letter and there would be no reply. The lack of a response was as good as a “yes” for Fisk. Grant was clearly on board, he thought.

He was wrong.

On September 20th, a Monday, Fisk’s broker started to buy and the markets subsequently panicked. Gold held steady at first at $130 for every $100 in greenback, but the next day Fisk worked his magic. He showed up in person and went on the offensive. Using threats and lies, including where he thought the president stood on the matter, Fisk spooked the floor.

The Bulls slaughtered the Bears.

Gold was bought, borrowed and sold. And Fisk and Gould, through various brokers, did all the buying. On Wednesday, gold closed slightly over 141, the highest price ever. In his typical showy style, Fisk couldn’t help but rub it in. He brazenly offered bets of 50-thousand dollars that the number would reach 145 by the end of the week. If someone took that sucker proposition, they lost. By Thursday, gold prices hit an astounding 150. The next day it would reach 160.

Then the bottom fell out.

At the White House, Grant was tipped off and furious. On September 24, a Friday, he put the government gold reserve up for sale and Gould and Fisk were effectively out of business. Thanks to the government sell off, almost immediately, gold prices plummeted back to the 130’s.

Many investors lost a bundle, but the two schemers got out mostly unscathed.